CGKY News Hub

Your go-to source for the latest insights and trends.

Insurance Policies: The Secret Life of Coverage

Uncover the hidden truths behind insurance policies and discover how the right coverage can change your life!

Unveiling the Basics: What You Need to Know About Insurance Policies

Understanding insurance policies is crucial for anyone looking to protect their assets and financial future. At its core, an insurance policy is a contract between the insurer and the insured, where the insurer agrees to compensate the insured for specified losses in exchange for a premium. There are several types of insurance policies, including health, life, auto, and home insurance, each tailored to address specific needs. For a comprehensive overview, consult Investopedia, which provides valuable insights into various insurance types.

When evaluating insurance policies, it's essential to consider factors such as coverage limits, deductibles, and exclusions. Each policy comes with a set of terms that define what is covered and what is not, making it vital for policyholders to read the fine print. Additionally, comparing multiple quotes from different insurers can help you find the best rates and coverage options. For more tips on selecting the right policy, visit NerdWallet.

Insurance Policies Decoded: Common Misconceptions and Key Facts

When it comes to insurance policies, many individuals hold onto common misconceptions that can lead to misunderstandings about coverage and benefits. One prevalent myth is that homeowners insurance covers all personal belongings within your residence. In reality, while it does offer coverage for certain events like theft or fire, specific possessions, such as valuable collectibles or high-end electronics, may require additional riders for full protection. Understanding these nuances is crucial for ensuring you have the right coverage in place.

Another frequent misconception is regarding the cost of insurance; many believe that a higher premium equates to better coverage. However, this isn’t always the case. For instance, auto insurance premiums can vary widely based on factors such as location, driving history, and credit score. It's essential to compare different policies and understand what each covers rather than just focusing on price. By demystifying these common myths, consumers can make informed decisions about their insurance needs.

How to Choose the Right Coverage: A Step-by-Step Guide to Insurance Policies

Choosing the right insurance coverage can be a daunting task, but breaking it down into manageable steps can simplify the process significantly. Begin by assessing your needs; consider factors such as your lifestyle, assets, and financial obligations. For example, if you own a home, you may want to look into homeowners insurance, while renters should explore renter's insurance options. Once you have a clear idea of what you need, research different types of insurance policies available to you, such as

- Health Insurance: essential for covering medical expenses.

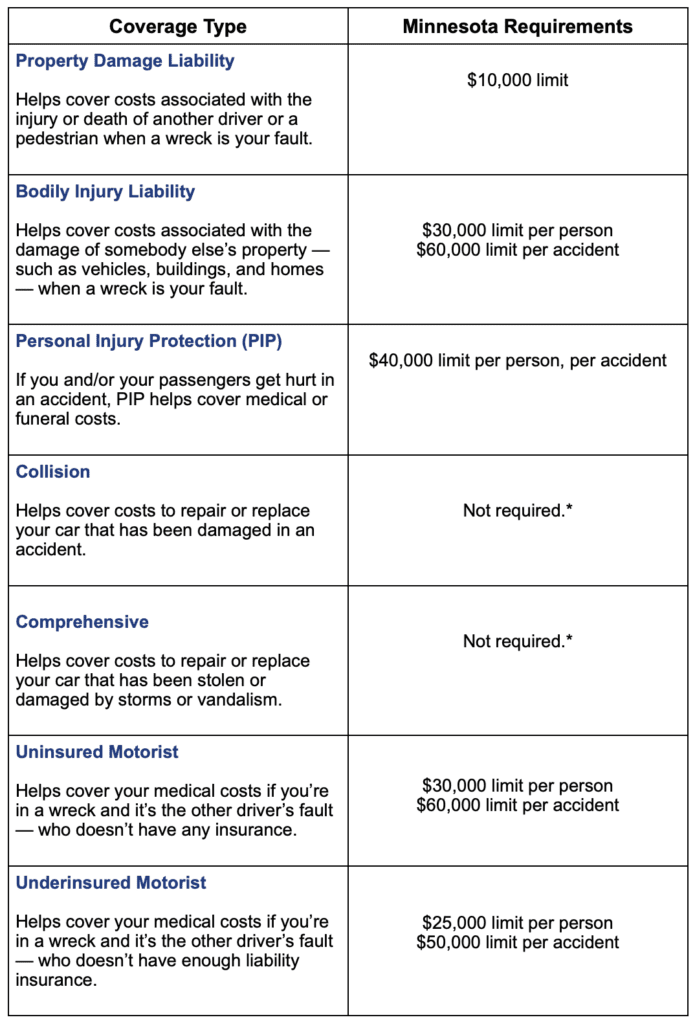

- Auto Insurance: required for vehicles to protect against accidents.

- Life Insurance: important for financial security of loved ones.

For more comprehensive details on these types, visit NerdWallet.

After narrowing down the types of coverage you need, the next step is comparing policies. Look at factors such as premiums, deductibles, and coverage limits. Use online tools to obtain quotes from various providers, allowing you to find the best deals while ensuring you get the coverage necessary for your situation. Additionally, consider reading customer reviews and checking the JD Power Insurance Ratings to gauge the reliability and customer service of different insurers. Finally, once you settle on a few options, don’t hesitate to ask questions and clarify any terms that are unclear—understanding the fine print can save you from unpleasant surprises down the line.