CGKY News Hub

Your go-to source for the latest insights and trends.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover the hidden benefits of term life insurance and how it can provide unbeatable financial security for your loved ones. Don't miss out!

What is Term Life Insurance and How Does It Work?

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. Unlike permanent life insurance, which lasts for your entire life, term life insurance is designed to pay a death benefit only if the insured person passes away during the policy term. This makes it a more affordable option for those looking to provide financial security for their loved ones without the higher premiums associated with permanent policies. Common reasons for purchasing term life insurance include covering a mortgage, funding children's education, or securing family income in the event of an untimely death.

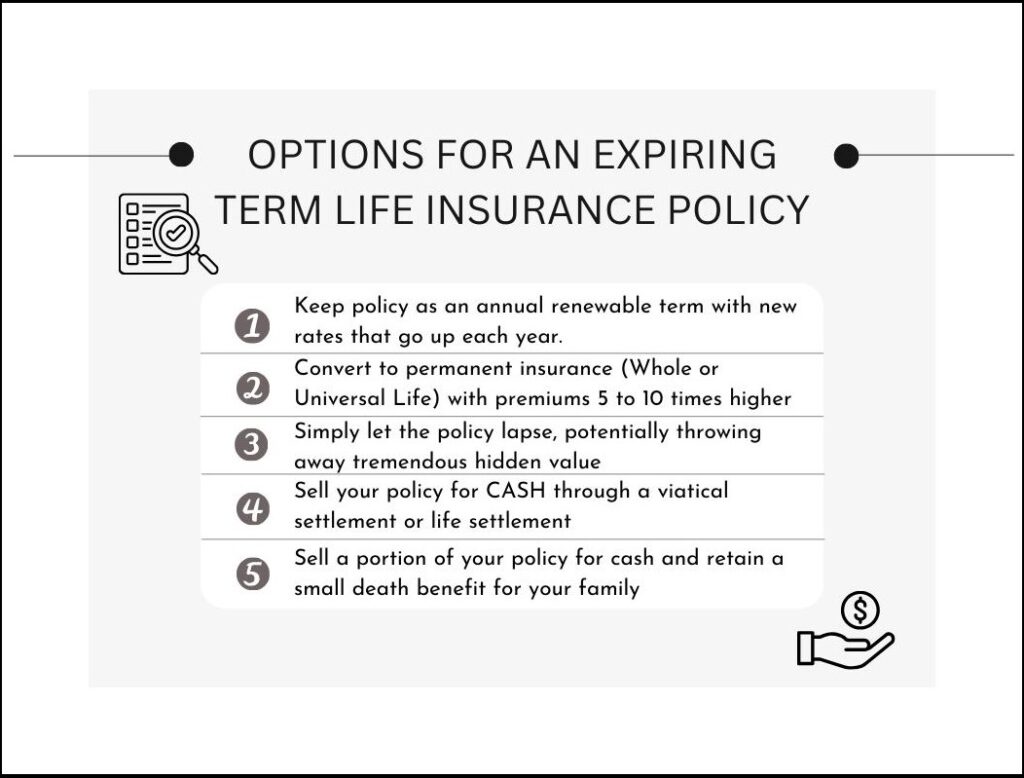

The way term life insurance works is relatively straightforward. When you buy a policy, you select the coverage amount and the duration of the term. In exchange for regular premium payments, the insurer agrees to pay a predetermined death benefit to your beneficiaries if you pass away during the term. If you outlive the policy, no benefit is paid, and the coverage simply ends. Some policies offer options to convert to permanent insurance or to renew at the end of the term, but these often come with increased costs. Understanding the details of your term life insurance policy is essential for ensuring that it meets your financial protection needs.

5 Reasons Why You Should Consider Term Life Insurance Today

When it comes to financial planning, term life insurance is often overlooked, yet it serves as a crucial safety net for families. Here are 5 reasons why you should consider term life insurance today:

- Affordability: Term life insurance typically offers lower premiums compared to whole life insurance, making it an affordable option for those on a budget.

- Flexibility: You can select a term that fits your needs, whether it's 10, 20, or 30 years, providing coverage during critical financial periods.

- Simplicity: The structure of term life insurance is straightforward, allowing for easy understanding and management.

- Financial Security: In the event of an untimely death, term life insurance provides your loved ones with the financial support they need to maintain their lifestyle.

- Peace of Mind: Knowing that you have a safety net in place can alleviate stress and allow you to focus on your life goals.

Is Term Life Insurance Right for You? Key Factors to Consider

When considering term life insurance, it's essential to evaluate your financial responsibilities and long-term goals. This type of insurance is designed to provide coverage for a specific period, typically ranging from 10 to 30 years, making it an affordable option for those who want substantial coverage without the high premiums associated with whole life policies. Ask yourself: do you have dependents, outstanding debts, or future financial obligations such as children's education? If your answer is yes, term life insurance may be a prudent choice to ensure your loved ones are financially secure in the event of your untimely passing.

Another critical factor to consider is your health status and lifestyle. Term life insurance policies often require medical exams or health questionnaires that can influence your premium rates. If you are young and healthy, you may qualify for lower rates, making it a wise decision to lock in coverage early. Additionally, think about the potential for changes in your circumstances, such as career advancements or increased family responsibilities. By evaluating these key factors, you can determine whether term life insurance is the right fit for your financial planning needs.