CGKY News Hub

Your go-to source for the latest insights and trends.

Why Paying Less for Auto Insurance is Actually a Smart Move

Unlock the secrets to saving big on auto insurance! Discover why paying less can be the smartest move you make for your wallet.

The Hidden Benefits of Choosing Affordable Auto Insurance

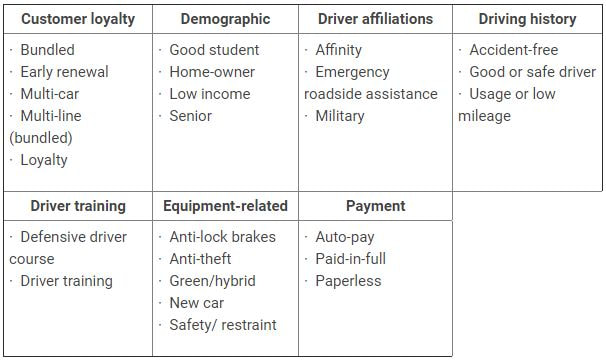

Choosing affordable auto insurance doesn't just lighten your financial load; it also opens up a realm of hidden benefits that many drivers overlook. One significant advantage is the ability to allocate your savings towards other essential areas of your life, such as emergency funds or road safety improvements. With the extra cash, you can invest in your vehicle's maintenance, purchase better tires, or enroll in defensive driving courses, all of which may lead to lower premiums in the future. Furthermore, affordable policies often come with fewer add-ons, which prompts individuals to reassess their necessities and avoid paying for features they might not need.

Moreover, affordable auto insurance often encourages drivers to shop around and compare policies, leading to better-informed decisions. This habit of research not only benefits your wallet but can also enhance your understanding of different coverage options available in the market. For instance, by exploring resources from trustworthy sites like Insurance.gov or Consumer Reports, you can learn about various auto insurance plans, discounts, and tips that can help you secure the best deal. In the end, affordable auto insurance can lead you to a more prudent and responsible approach to vehicle ownership.

How Paying Less for Auto Insurance Can Save You Money in the Long Run

When it comes to managing your finances, paying less for auto insurance might not only seem like a small win, but it can lead to substantial savings over time. By shopping around and comparing rates, you can find policies that offer the same level of coverage at a lower price. Websites like NerdWallet provide tools to help consumers compare quotes from several insurance providers, ensuring you make an informed decision. Furthermore, many insurers offer discounts for safe driving records and bundling policies, which can lower your premiums even more, resulting in noticeable savings on your monthly budget.

In addition to immediate savings, paying less for auto insurance can have compounding benefits. By reducing your insurance expenses, you can allocate those funds into savings or investments, potentially allowing your money to grow over time. For instance, setting aside the difference could contribute to a retirement fund or an emergency savings account, thus enhancing your financial stability. According to the Consumer Reports, even a small monthly saving can add up to a significant amount over the years, demonstrating that even minor adjustments in your insurance payments can lead to lasting financial benefits.

Is Cheaper Auto Insurance Really a Smart Choice? Find Out Here!

When it comes to choosing auto insurance, cheaper auto insurance may seem like an attractive option for budget-conscious drivers. However, it’s essential to consider what you might be sacrificing for lower premiums. Cheaper policies often come with higher deductibles or may lack crucial coverage options that can leave you financially vulnerable in the event of an accident. According to Insure.com, a low-cost policy might not provide sufficient protection, potentially leading to hefty out-of-pocket expenses down the road.

Additionally, the claims process and customer service can vary significantly between insurance providers. Some budget insurers may not offer the level of support you need when you file a claim. As noted by Consumer Reports, it's crucial to weigh not just the cost but also the quality of service when selecting your coverage. Remember, while cheaper auto insurance may save you money upfront, it could ultimately lead to greater expenses—both financially and in peace of mind—if not carefully considered.