CGKY News Hub

Your go-to source for the latest insights and trends.

Behind the Curtain: The Secret World of Anonymous Deposits

Uncover the hidden secrets of anonymous deposits! Discover how they work and why they're a game-changer in the financial world.

Understanding Anonymous Deposits: What You Need to Know

Understanding Anonymous Deposits is essential for anyone interested in maintaining privacy in their financial transactions. These deposits can be made through various channels, such as cryptocurrency exchanges or private banking services, allowing individuals to keep their identities hidden. It's important to note that while anonymous deposits offer privacy advantages, they also raise potential legal and ethical concerns. Transactions might be scrutinized by financial authorities, as anonymity can sometimes be associated with illicit activities.

Before engaging in anonymous deposits, consider the following crucial factors:

- Legality: Ensure you understand the laws governing anonymous transactions in your jurisdiction.

- Security: Use reputable services to minimize risks of fraud.

- Traceability: Be aware that complete anonymity is challenging; even anonymous transactions can be traced with advanced technology.

Counter-Strike is a highly competitive first-person shooter game that involves two teams, terrorists and counter-terrorists, battling to accomplish various objectives. Players must utilize strategy and teamwork to succeed, while also managing their resources effectively. For players looking to enhance their gaming experience, they might find useful bonuses by checking out the stake promo code for various promotions.

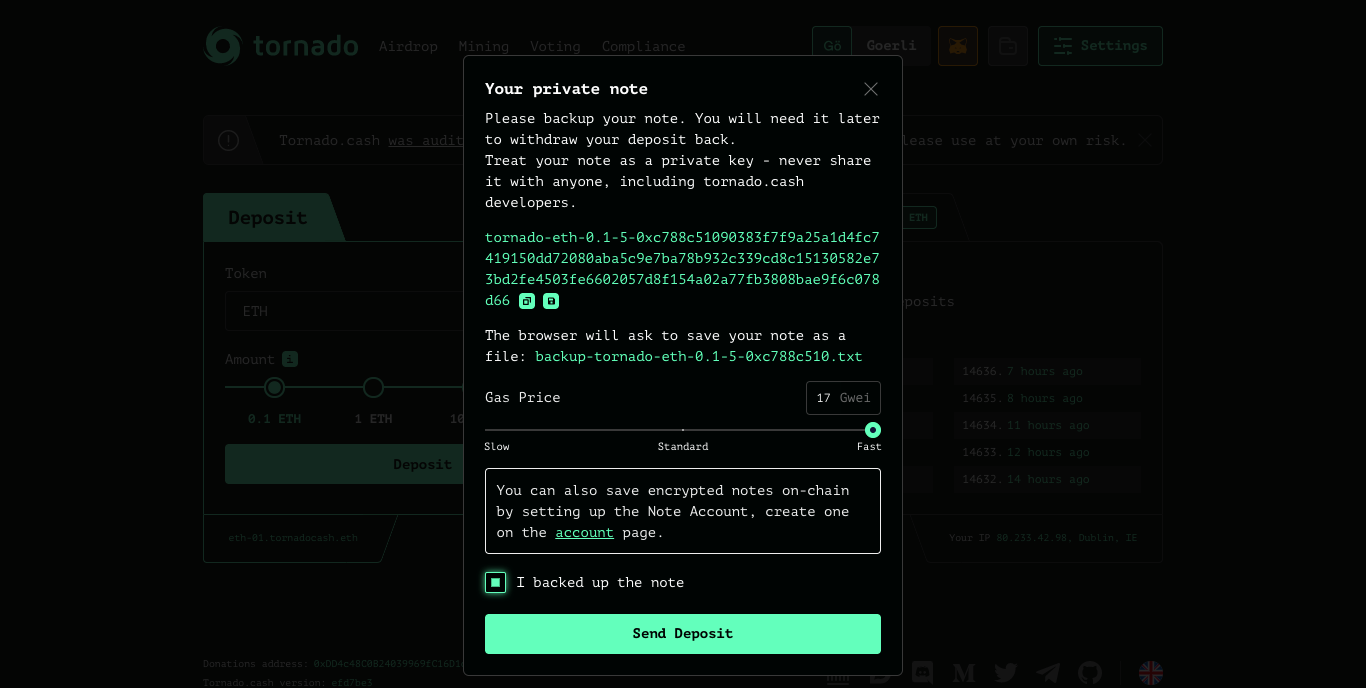

The Mechanics of Anonymous Deposits: How They Work in Practice

The mechanics of anonymous deposits have garnered significant attention in financial discussions, particularly in the realms of privacy and security. These transactions allow individuals to deposit funds without revealing their identity or personal information, thereby offering a layer of protection against data breaches and unwanted scrutiny. Typically, anonymous deposits are facilitated through services such as digital wallets, prepaid cards, or cash deposits at certain financial institutions that prioritize user confidentiality. This concept has evolved with the rise of cryptocurrencies, where decentralized networks enable peer-to-peer transactions with minimal oversight.

In practice, anonymous deposits can be executed in various ways. For instance, cryptocurrency exchanges often allow users to create accounts without extensive documentation, enabling them to deposit funds electronically while maintaining their anonymity. Additionally, some individuals utilize methods like third-party intermediaries or privacy-focused banking options to obscure the source of their funds. However, it's essential to understand the legal implications associated with such transactions, as jurisdictions vary on regulations concerning anonymity in banking practices. The balance between maintaining anonymity and complying with anti-money laundering (AML) laws is a delicate one that must be navigated carefully.

Are Anonymous Deposits Legal? Debunking Common Myths

The question of whether anonymous deposits are legal is often surrounded by confusion and misinformation. Many people believe that any form of anonymity in financial transactions is illegal, associating it with illicit activities. However, this is not entirely true. Depending on the jurisdiction and the specific financial institutions involved, anonymous deposits can be perfectly legal. In some cases, banks allow customers to deposit money without disclosing their identity, provided that the source of the funds is legitimate. Understanding the regulations governing anonymity in banking is essential for anyone considering these types of transactions.

Moreover, it is important to recognize that myths about anonymous deposits can lead to misshaped perceptions. One common myth is that all forms of anonymous transactions are used for money laundering or tax evasion. This stereotype overlooks the fact that many individuals may opt for privacy in their financial dealings for legitimate reasons, such as personal safety or privacy concerns. Transparency in banking does not necessarily mean eliminating anonymity altogether; rather, it involves finding a balance between privacy and regulatory compliance. To fully understand the legality and implications of anonymous deposits, educating oneself on local laws and engaging with reputable financial services is crucial.